Embark on a journey to uncover the intricacies of a life insurance policy quote, delving into the crucial details that shape this financial decision. As we navigate through the nuances of coverage, premiums, and additional options, a comprehensive understanding awaits you.

Exploring the realm of life insurance policy quotes opens doors to a realm of knowledge that empowers individuals to make informed choices about their financial security.

What to Expect From a Life Insurance Policy Quote

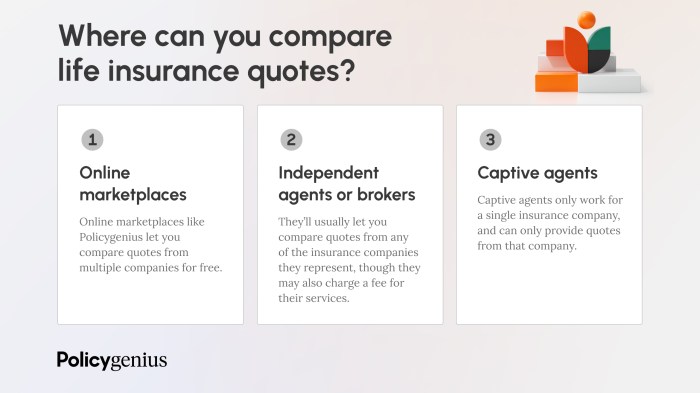

When looking into life insurance, one of the first steps is to obtain a life insurance policy quote. This quote provides an estimate of the cost and coverage you can expect from a particular life insurance policy. It serves as a crucial tool in helping individuals make informed decisions about their financial planning and protection for their loved ones in the event of their passing.

Purpose of a Life Insurance Policy Quote

A life insurance policy quote is designed to give individuals an idea of how much they will need to pay for a specific coverage amount. It helps individuals understand the financial commitment required to secure protection for their beneficiaries. Additionally, the quote allows individuals to compare different insurance options and choose the one that best fits their needs and budget.

Information Included in a Life Insurance Policy Quote

Coverage Amount

The sum of money that will be paid out to beneficiaries upon the policyholder's death.

Premium

The cost you will need to pay regularly (monthly or annually) to maintain the policy.

Policy Type

Whether it is term life insurance, whole life insurance, universal life insurance, or another type.

Policy Riders

Additional features or benefits that can be added to the policy for an extra cost.

Exclusions

Any situations or conditions that are not covered by the policy.

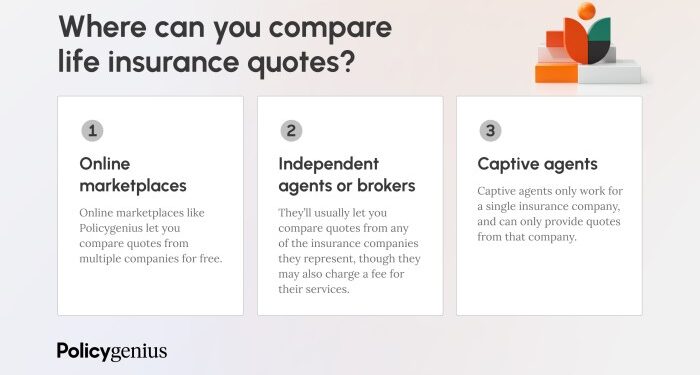

Types of Life Insurance Policy Quotes

Term Life Insurance Quote

Provides coverage for a specific period (term) and is typically more affordable.

Whole Life Insurance Quote

Offers coverage for the entire life of the policyholder and includes a cash value component.

Universal Life Insurance Quote

Combines a death benefit with a savings component that can earn interest over time.

Variable Life Insurance Quote

Allows policyholders to invest their cash value in different accounts for potential growth.

Understanding Life Insurance Coverage

Life insurance policies offer various coverage options to meet different needs and preferences. Understanding these coverage options is crucial in selecting the right policy that suits your requirements.

Coverage Options in Life Insurance Policies

- Term Life Insurance: Provides coverage for a specific period, such as 10, 20, or 30 years.

- Whole Life Insurance: Offers coverage for your entire life and includes a cash value component.

- Universal Life Insurance: Combines a death benefit with a savings component that earns interest.

- Variable Life Insurance: Allows you to invest the cash value portion in various investment options.

Determining Coverage Amount in a Life Insurance Policy Quote

The coverage amount in a life insurance policy quote is typically determined based on several factors, including:

- Your income and financial obligations

- Your age, health, and lifestyle habits

- Your long-term financial goals and beneficiaries' needs

It's essential to assess your current and future financial needs to ensure you have adequate coverage in your life insurance policy.

Importance of Understanding Coverage Details

Before selecting a life insurance policy, it is crucial to thoroughly understand the coverage details to make an informed decision. Some key points to consider include:

- Exclusions and limitations of coverage

- Premium amounts and payment frequency

- Policy renewal and cancellation terms

- Beneficiary designation and payout options

Factors Influencing Life Insurance Premiums

When obtaining a life insurance policy quote, there are several key factors that can influence the premium cost. Understanding these factors is crucial in determining the right coverage for your needs.

Age

Age is a significant factor that impacts life insurance premiums. Generally, the younger you are when you purchase a policy, the lower your premiums will be. This is because younger individuals are considered lower risk and are less likely to have serious health issues.

Health

Your current health status plays a crucial role in determining your life insurance premiums. Insurance companies will assess your medical history, pre-existing conditions, and lifestyle habits to evaluate the level of risk you present. Individuals with better health profiles typically receive lower premium rates.

Lifestyle

Your lifestyle choices, such as smoking, drinking, or engaging in high-risk activities, can impact your life insurance premiums. Risky behaviors can lead to higher premiums as they increase the likelihood of premature death or health complications.

Coverage Amount

The coverage amount you choose will also affect your life insurance premiums. Higher coverage amounts result in higher premiums since the insurance company will need to provide a larger payout in the event of your passing. It's essential to find a balance between the coverage you need and the premiums you can afford.

Additional Riders and Options

When considering a life insurance policy, it's important to be aware of the additional riders and options that can be included to customize your coverage based on your specific needs. These riders can enhance your policy by providing extra benefits or flexibility.

Popular Riders and Their Potential Benefits

- Accidental Death Benefit Rider:Provides an additional payout if the insured's death is the result of an accident, offering financial protection beyond the base policy.

- Waiver of Premium Rider:Waives premium payments if the policyholder becomes disabled and unable to work, ensuring the policy remains active.

- Accelerated Death Benefit Rider:Allows the insured to access a portion of the death benefit if diagnosed with a terminal illness, helping cover medical expenses or providing financial assistance.

- Child Term Rider:Extends coverage to children of the insured, offering financial protection in case of a child's unexpected passing.

Last Word

In conclusion, grasping the elements of a life insurance policy quote equips you with the tools to navigate the realm of financial planning with confidence and clarity. As you embark on this journey towards safeguarding your future, may the insights gained here illuminate your path to a secure tomorrow.

Clarifying Questions

What factors influence the premium cost in a life insurance policy quote?

The premium cost can be impacted by factors such as age, health status, lifestyle choices, and the coverage amount desired by the policyholder.

What are some common riders and additional options that can be included in a life insurance policy?

Common riders include accidental death benefit, waiver of premium, and accelerated death benefit. These options can provide additional coverage or benefits to policyholders.

How is the coverage amount determined in a life insurance policy quote?

The coverage amount is typically determined based on factors such as income, liabilities, and future financial needs of the insured individual.

Why is it important to understand the coverage details before selecting a policy?

Understanding the coverage details ensures that the policy aligns with your financial goals and provides the necessary protection for your loved ones in the future.