Exploring the crucial link between wellness and financial stability, this guide delves into how prioritizing well-being can impact your financial health. From the benefits of investing in wellness to practical tips on budgeting, this topic sheds light on the intersection of wellness and financial success.

The Connection Between Wellness and Financial Stability

Wellness plays a crucial role in achieving financial stability as it directly impacts an individual's overall well-being, including physical, mental, and emotional health. When individuals prioritize their wellness, they are better equipped to make sound financial decisions and maintain financial stability.

Improved Physical Health

Improving physical health through regular exercise and a balanced diet can lead to lower healthcare costs and fewer sick days, ultimately saving money in the long run. Additionally, staying physically healthy can increase productivity at work, potentially leading to promotions or salary increases.

Enhanced Mental Well-being

Maintaining good mental health by managing stress and seeking support when needed can prevent costly mental health issues down the line. Individuals with good mental well-being are more likely to make rational financial decisions and avoid impulsive spending.

Work-Life Balance

Finding a balance between work and personal life is essential for overall wellness. By prioritizing self-care and relaxation, individuals can reduce burnout and improve job performance, which can result in better career opportunities and financial growth.

Financial Benefits of Prioritizing Wellness

Investing in wellness activities can lead to significant long-term cost savings. By focusing on maintaining a healthy lifestyle, individuals can reduce their healthcare expenses and improve overall productivity. Let's explore some ways in which prioritizing wellness can have financial benefits:

Reducing Healthcare Costs

- Regular exercise and healthy eating habits can help prevent chronic diseases such as diabetes, heart disease, and obesity, ultimately reducing medical bills and the need for expensive treatments.

- Engaging in stress-reducing activities like yoga or meditation can lower the risk of developing mental health issues, reducing the need for costly therapy or medication.

- Annual check-ups and preventive screenings can catch health issues early, avoiding costly emergency room visits and hospital stays.

Improving Productivity

- Employees who prioritize wellness are often more focused, energetic, and motivated, leading to increased productivity in the workplace and potentially higher earnings.

- Wellness programs in companies have been shown to reduce absenteeism due to illness, saving both the employer and the employee money in lost wages and productivity.

Financial Incentives for Healthy Living

- Some employers offer financial incentives such as discounted gym memberships, wellness bonuses, or lower health insurance premiums for employees who participate in wellness programs or meet certain health goals.

- Insurance companies may provide lower premiums or cash rewards for policyholders who demonstrate healthy behaviors like quitting smoking, maintaining a healthy weight, or attending regular health screenings.

Wellness Programs in the Workplace

Wellness programs play a crucial role in enhancing employees' financial stability by promoting healthy behaviors, reducing healthcare costs, and increasing productivity.

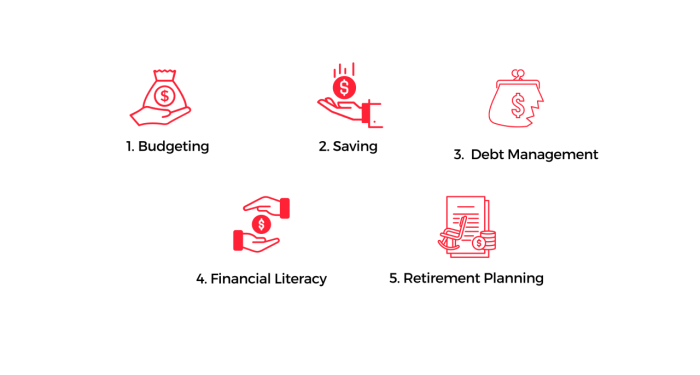

Types of Workplace Wellness Initiatives and Financial Impact

There are various types of workplace wellness initiatives that can positively impact employees' financial well-being:

- Physical Wellness Programs: These initiatives focus on promoting physical health through activities like exercise challenges, gym memberships, and healthy eating programs. By encouraging employees to maintain a healthy lifestyle, these programs can reduce healthcare costs and decrease absenteeism, leading to improved financial stability.

- Mental Health Support: Programs that provide resources for managing stress, anxiety, and mental health issues can enhance employees' overall well-being. By addressing mental health concerns, employers can help their staff stay focused, productive, and financially stable.

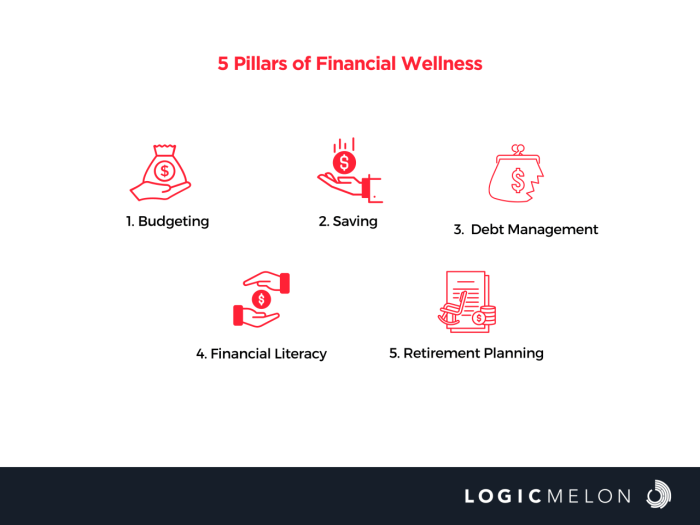

- Financial Education Workshops: Offering workshops on budgeting, saving, investing, and retirement planning can empower employees to make informed financial decisions. By improving financial literacy, employers can support their staff in achieving long-term financial stability.

Supporting Employees' Wellness for Improved Financial Health

Employers can support their employees' wellness in various ways to enhance their overall financial health:

- Providing Access to Wellness Programs: Offering a range of wellness initiatives and resources can encourage employees to prioritize their health and well-being, leading to reduced healthcare costs and increased productivity.

- Flexible Work Arrangements: Allowing for flexible work schedules, remote work options, and mental health days can help employees achieve a better work-life balance, reducing stress and improving financial stability.

- Creating a Positive Work Environment: Fostering a supportive and inclusive workplace culture can promote employee well-being and engagement, ultimately contributing to enhanced financial health and stability.

Budgeting for Wellness

When it comes to achieving financial stability, budgeting for wellness is a crucial aspect that is often overlooked. Incorporating wellness expenses into your budget not only helps improve your overall well-being but also has long-term financial benefits.

Strategies for Incorporating Wellness Expenses into a Budget

- Create a separate category in your budget specifically for wellness expenses, including gym memberships, healthy groceries, and self-care products.

- Set realistic goals for your wellness spending and track your expenses regularly to ensure you stay within your budget.

- Prioritize essential wellness expenses such as preventive healthcare services and mental health support to maintain a healthy lifestyle.

Tips on Prioritizing Wellness Spending without Compromising Financial Stability

- Allocate a portion of your budget for wellness expenses just like you would for other essential needs like housing and utilities.

- Look for cost-effective ways to prioritize wellness, such as exercising at home or preparing healthy meals instead of dining out frequently.

- Consider investing in preventive healthcare to avoid costly medical bills in the future, ultimately saving you money in the long run.

Long-Term Financial Benefits of Budgeting for Wellness

- By prioritizing wellness in your budget, you are investing in your long-term health and well-being, reducing the risk of future medical expenses.

- Maintaining a healthy lifestyle can lead to increased productivity and energy levels, potentially resulting in higher earnings or career advancement.

- Budgeting for wellness helps you develop good financial habits and teaches you the importance of balancing short-term expenses with long-term goals.

Final Review

In conclusion, understanding the role of wellness in achieving financial stability is key to securing a prosperous future. By making conscious choices to prioritize your well-being, you pave the way for a healthier financial outlook. Embrace wellness as a cornerstone of your financial journey and watch as stability and success become intertwined in your life.

Quick FAQs

How does wellness impact financial stability?

Improving wellness can lead to reduced healthcare costs, increased productivity, and overall better financial outcomes.

What are some examples of financial incentives for maintaining a healthy lifestyle?

Financial incentives can include lower insurance premiums, employer-sponsored wellness programs, and discounts on gym memberships.

How can employers support their employees' wellness for better financial health?

Employers can offer wellness programs, flexible work arrangements, and mental health resources to support their employees' overall well-being.