Beginning with How to Find a Trusted Financial Advisor Near You (Global Guide), the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Exploring the world of financial advisors can be a daunting task, but with the right guidance, finding a trusted advisor near you becomes a seamless process.

Researching Financial Advisors

Researching financial advisors is a crucial step in finding a trusted professional to handle your finances. By conducting thorough research, you can ensure that you are making an informed decision and selecting an advisor who aligns with your financial goals and values.

Key Factors to Consider When Researching Financial Advisors

- Qualifications and Credentials: Look for advisors who have relevant certifications, such as Certified Financial Planner (CFP) or Chartered Financial Consultant (ChFC).

- Experience: Consider the number of years the advisor has been in the industry and their track record of success.

- Fiduciary Duty: Choose an advisor who is a fiduciary, meaning they are legally obligated to act in your best interest.

- Fee Structure: Understand how the advisor is compensated, whether through fees, commissions, or a combination of both.

- Communication Style: Ensure that the advisor communicates clearly and regularly, keeping you informed about your financial situation.

Benefits of Seeking Recommendations from Friends or Family

- Personalized Referrals: Recommendations from people you trust can provide valuable insights into the advisor's approach and services.

- Real-Life Experiences: Hearing about firsthand experiences with a financial advisor can help you gauge their reliability and professionalism.

- Peace of Mind: Knowing that someone you know has had a positive experience with a particular advisor can give you confidence in your decision.

Qualifications and Credentials

When seeking a financial advisor, it is crucial to verify their qualifications and credentials to ensure they have the necessary expertise and ethical standards to handle your finances effectively. This can help you feel confident in their ability to provide sound financial advice tailored to your specific needs.

Common Certifications and Qualifications

- Certified Financial Planner (CFP): Demonstrates expertise in financial planning, investments, insurance, and retirement planning.

- Chartered Financial Analyst (CFA): Focuses on investment management and analysis, indicating a deep understanding of financial markets.

- Chartered Financial Consultant (ChFC): Specializes in comprehensive financial planning, including estate planning and tax strategies.

- Registered Investment Advisor (RIA): Adheres to fiduciary standards, putting clients' interests first in investment recommendations.

Regulatory Oversight of Financial Advisors

Regulatory bodies play a crucial role in overseeing financial advisors globally to protect consumers from fraud and unethical practices. These regulatory bodies establish and enforce standards of conduct, licensing requirements, and disciplinary actions to maintain the integrity of the financial advisory industry.

Understanding Fee Structures

When seeking financial advice, it is crucial to understand the fee structures that financial advisors may use. This knowledge can help you make informed decisions and ensure transparency in your financial planning process.Commission-based advisors:Commission-based advisors earn their income through the sale of financial products.

They receive a commission for every product they sell to their clients. While this can lead to potential conflicts of interest, as advisors may prioritize products that offer higher commissions, it is essential to note that commission-based advisors may not charge clients directly for their services.Fee-only advisors:On the other hand, fee-only advisors charge clients directly for their services.

They do not earn commissions from financial product sales, which can eliminate conflicts of interest. Fee-only advisors typically charge a percentage of the assets they manage or an hourly rate for their services. This fee structure can offer a more transparent and objective approach to financial advice.Importance of transparency:Transparency in fee structures is crucial for financial advisory services.

Clients should fully understand how their advisors are compensated to ensure that the advice they receive is in their best interest. By knowing the fee structure upfront, clients can make informed decisions and avoid potential conflicts of interest. Therefore, when choosing a financial advisor, it is essential to prioritize transparency in fee structures to build a trusting and beneficial advisor-client relationship.

Meeting Potential Advisors

When meeting potential financial advisors, it is crucial to ask the right questions, understand the initial consultation process, and evaluate compatibility and trustworthiness. Here are key points to consider:

Key Questions to Ask

- What is your experience in financial planning?

- Can you explain your investment philosophy?

- How do you communicate with your clients?

- What are your fees and how are they structured?

Initial Consultation Process

The initial consultation with a financial advisor is typically a meeting to get to know each other. They may ask about your financial goals, risk tolerance, and current financial situation. This is also your opportunity to ask questions and assess if they are a good fit for your needs.

Evaluating Compatibility and Trustworthiness

During the first meeting, pay attention to how well the advisor listens to your concerns and goals. Assess if they explain complex financial concepts clearly and if you feel comfortable discussing personal financial matters with them. Trust your instincts and ensure that you feel a sense of trust and compatibility with the advisor.

Performing Background Checks

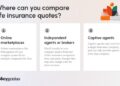

When choosing a financial advisor, it is crucial to conduct thorough background checks to ensure you are entrusting your financial well-being to a trustworthy professional. By researching their background, you can gain valuable insights into their qualifications, experience, and any red flags that may indicate potential issues.

Resources and Tools for Background Checks

- FINRA BrokerCheck: This tool allows you to research the background and experience of financial brokers and firms registered with FINRA.

- SEC Investment Adviser Public Disclosure: Use this resource to verify the registration status and review the disciplinary history of investment advisors registered with the SEC.

- Certification Verification Websites: Verify the credentials and certifications claimed by the financial advisor through official certification verification websites.

Red Flags to Watch Out For

- History of Disciplinary Actions: Look for any history of disciplinary actions, complaints, or legal issues against the financial advisor.

- Conflicts of Interest: Be wary of advisors who have undisclosed conflicts of interest or who push certain financial products for their benefit rather than yours.

- Poor Track Record: Check for any negative reviews, complaints, or lawsuits that may indicate a poor track record in managing clients' finances.

Reading Client Reviews and Testimonials

When choosing a financial advisor, one of the crucial steps is to read client reviews and testimonials. These first-hand accounts can provide valuable insights into the advisor's reputation, reliability, and level of service.

Analyzing and Interpreting Client Feedback

Before making a decision based on client reviews, it's essential to analyze and interpret the feedback effectively. Look for recurring themes or patterns in the reviews to get a comprehensive understanding of the advisor's strengths and weaknesses.

- Pay attention to specific examples or anecdotes shared by clients to gauge the advisor's expertise and approach.

- Consider the overall tone of the reviews to assess the level of satisfaction and trust clients have in the advisor.

- Look for reviews that mention outcomes or results achieved with the advisor's guidance to evaluate their track record.

Distinguishing Authentic Reviews

Authenticity is key when reading client reviews, as some testimonials may be biased or manipulated. Here are some tips to help you distinguish authentic reviews from potentially biased ones:

- Check for details and specifics in the reviews, as generic or vague feedback may indicate a lack of credibility.

- Look for reviews from verified clients or sources to ensure they are genuine and trustworthy.

- Consider the overall balance of positive and negative reviews to get a more balanced perspective on the advisor.

Final Summary

In conclusion, navigating the realm of financial advisors to find a trustworthy one requires attention to detail and thorough research. By following the guidelines provided, you can confidently choose a financial advisor who meets your needs and goals.

Quick FAQs

What are the key factors to consider when researching financial advisors?

When researching financial advisors, consider factors such as their experience, reputation, fees, and areas of expertise to make an informed decision.

How can I evaluate the compatibility of a financial advisor during the first meeting?

To evaluate compatibility, ask about their investment philosophy, communication style, and approach to financial planning to see if it aligns with your preferences and goals.

Why is it important to read client reviews and testimonials when choosing a financial advisor?

Reading client reviews helps you gauge the satisfaction level of past clients and gives insight into the advisor's working style and professionalism.