When delving into the realm of life assurance and life insurance, it's crucial to distinguish between the two. Understanding the nuances can make a significant impact on financial planning and security. Let's explore the key disparities and uncover which option might be the best fit for you.

Understanding Life Assurance and Life Insurance

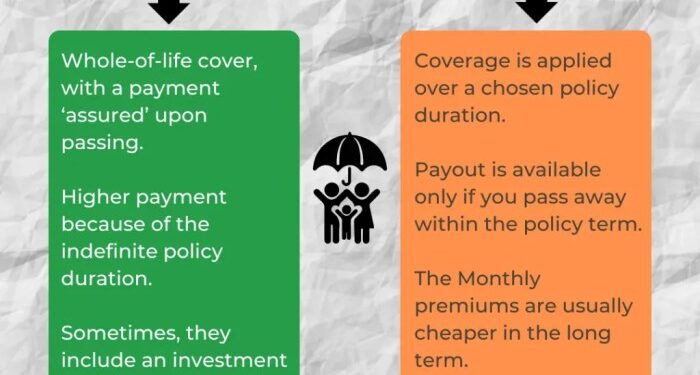

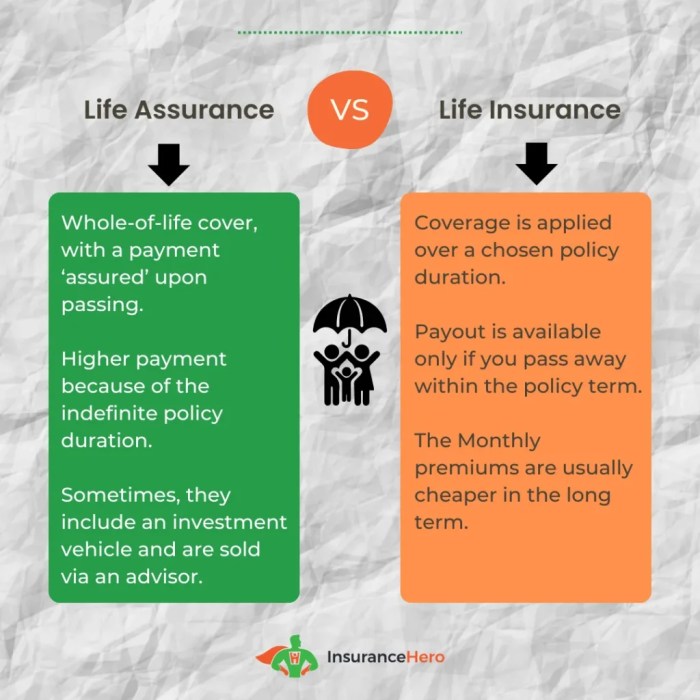

Life assurance and life insurance are both financial products designed to provide a payout to beneficiaries in the event of the policyholder's death. However, there are key differences between the two.Life assurance is a type of insurance that provides coverage for the entire lifetime of the policyholder.

It guarantees a payout upon the policyholder's death, whenever that may occur. On the other hand, life insurance typically provides coverage for a specified term, such as 10, 20, or 30 years. If the policyholder dies within the term, a payout is made to the beneficiaries.In situations where long-term financial protection is needed, life assurance may be more suitable than life insurance.

For example, if the policyholder wants to ensure that their beneficiaries are taken care of regardless of when they pass away, life assurance would be the better choice.Life assurance and life insurance work similarly in terms of coverage and benefits.

Both require the policyholder to pay premiums to maintain coverage. The amount of the payout, known as the death benefit, is predetermined when the policy is purchased. Additionally, both types of policies may offer optional riders or add-ons for additional coverage, such as critical illness or disability benefits.

Coverage and Benefits

Life assurance and life insurance offer different types of coverage and benefits to policyholders. Let's delve into the specifics of each to understand their differences.

Life Assurance Coverage

Life assurance typically provides coverage for the entire lifetime of the policyholder. In the event of death, a lump sum is paid out to the beneficiaries. This type of policy offers a guaranteed payout and is often used for estate planning and inheritance purposes.

Life Insurance Coverage

Life insurance, on the other hand, provides coverage for a specific term, such as 10, 20, or 30 years. If the policyholder passes away during the term, a death benefit is paid out to the beneficiaries. However, if the policyholder outlives the term, no benefit is paid out.

Benefits Comparison

- Life assurance offers a guaranteed payout upon the death of the policyholder, providing financial security to beneficiaries.

- Life insurance provides coverage for a specific term, making it more affordable for younger individuals who may not need lifelong coverage.

- Life assurance can be used for estate planning and inheritance purposes, ensuring that beneficiaries receive a lump sum to cover expenses or inheritances.

- Life insurance is more flexible in terms of coverage options, allowing policyholders to choose the term length and coverage amount based on their needs.

Flexibility of Coverage Options

Both life assurance and life insurance offer flexibility in coverage options, but in different ways. Life assurance provides lifelong coverage with a guaranteed payout, while life insurance allows policyholders to choose the term length and coverage amount. This flexibility caters to different financial planning needs and preferences, making it easier for individuals to find a policy that fits their specific circumstances.

Premiums and Payouts

When it comes to life assurance and life insurance, understanding how premiums are calculated and what the payout process entails is crucial for making informed decisions about your coverage.

Life Assurance Premiums

In life assurance, premiums are calculated based on several factors such as the age of the policyholder, their health condition, lifestyle choices, and the coverage amount desired. The insurer assesses the level of risk associated with insuring the individual and determines the premium accordingly.

Typically, life assurance premiums tend to be higher compared to life insurance due to the long-term nature of the policy and the guaranteed payout.

Life Insurance Premiums

On the other hand, life insurance premiums are calculated based on similar factors as life assurance, but the coverage is usually for a specific term, such as 10, 20, or 30 years. The premiums are generally lower compared to life assurance since there is no guaranteed payout at the end of the policy if the policyholder outlives the term

Cost-Effectiveness of Premiums

When comparing the cost-effectiveness of premiums between life assurance and life insurance, it ultimately depends on your individual needs and financial goals. Life assurance may offer a higher level of financial protection and a guaranteed payout, but it comes at a higher cost.

On the other hand, life insurance may be more affordable in the short term but does not provide the same level of long-term security.

Payout Process

In both life assurance and life insurance, the payout process is straightforward. Upon the death of the policyholder, the beneficiaries need to file a claim with the insurance company and provide the necessary documentation. Once the claim is approved, the insurer will issue the payout to the beneficiaries according to the terms of the policy.

It's essential to review the policy details to understand any specific conditions or exclusions that may apply to the payout process.

Suitability and Considerations

When choosing between life assurance and life insurance, several factors need to be considered to ensure the right choice for your needs. Age, health status, lifestyle, and financial goals play a significant role in determining eligibility and suitability for each option.

Understanding these factors can help individuals make informed decisions when selecting coverage.

Impact of Age, Health, and Lifestyle

- Age: Younger individuals generally have lower premiums for life insurance due to lower risk. On the other hand, older individuals may find life assurance more suitable as it offers coverage for a longer term.

- Health: Health conditions can affect eligibility for both life assurance and life insurance. Individuals with pre-existing conditions may find life assurance more accessible, as it typically does not require a medical exam.

- Lifestyle: Risky behaviors such as smoking or engaging in extreme sports can impact premiums for both life assurance and life insurance. It's essential to disclose lifestyle factors to insurers to determine the best coverage.

Tips for Determining Suitability

- Evaluate your long-term financial goals to determine the type of coverage you need.

- Consider your current health status and any pre-existing conditions that may affect eligibility.

- Compare premiums and payouts between life assurance and life insurance to see which aligns better with your budget and coverage needs.

Real-Life Scenarios

- Life Assurance: A young individual with a stable job and long-term financial commitments may benefit more from life assurance to ensure coverage for their loved ones in the future.

- Life Insurance: An older individual with existing health conditions may find life insurance more suitable due to its immediate coverage and lower premiums for their current situation.

Final Wrap-Up

In conclusion, navigating the landscape of life assurance and life insurance unveils a myriad of considerations. By grasping the disparities in coverage, benefits, premiums, and suitability, individuals can make informed choices that align with their unique needs and circumstances.

FAQ

What is the main difference between life assurance and life insurance?

Life assurance typically provides coverage for the entire lifetime of the insured, while life insurance covers a specific term.

How are premiums calculated in life assurance?

Premiums in life assurance are usually calculated based on factors like age, health, and lifestyle habits.

When is life assurance more suitable than life insurance?

Life assurance might be preferable when seeking lifelong coverage and investment components.